In a forecast released Friday via “Bitcoin has a 90% chance of reaching a new ATH before March 2025,” Peterson declared.

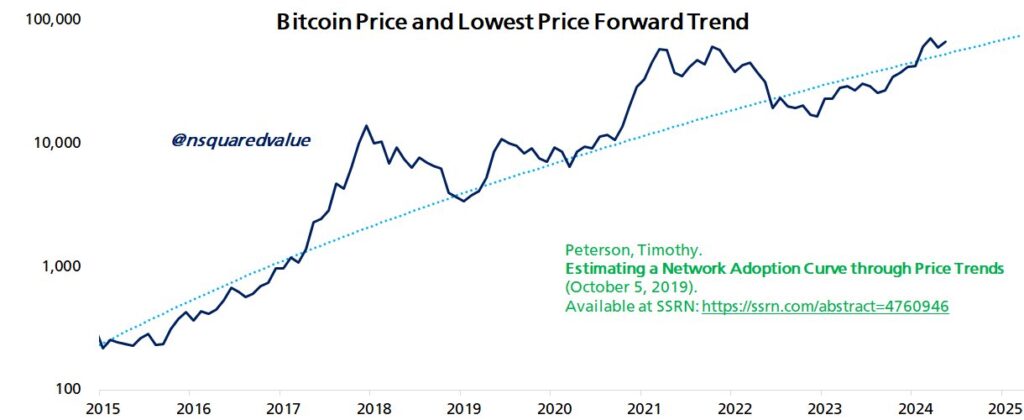

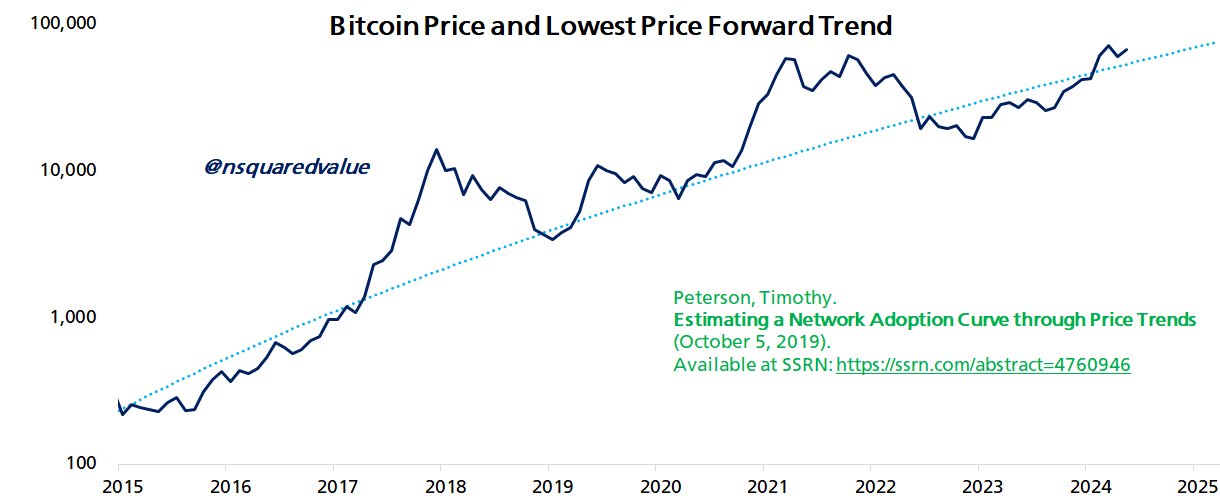

Peterson, known for works such as Metcalfe’s Law as a Model of Bitcoin Value, bases his predictions on an analytical framework detailed in his research paper titled Minimum Price Forward: Why Bitcoin Prices Never Turn Back . The paper, first published in 2019 and subsequently revised, introduces an innovative approach to understanding Bitcoin’s price trajectory by focusing on Bitcoin’s all-time low price, known as the “never look back price” (NLB). This NLB marked the last time Bitcoin traded at a specific price point, with Bitcoin never falling to that level again.

Related Reading

Peterson’s approach involves plotting these NLB data points on a lognormal scale, adjusted by what he calls a “square root time” scale. This unconventional metric helps provide a deeper understanding of Bitcoin’s long-term growth pattern and effectively compares it to the diffusion process observed in technology adoption in other areas.

Bitcoin adoption is key

At the heart of Peterson’s analysis is Metcalfe’s Law, which he elaborates as “the value of a network is proportional to the square of the number of its users.” By applying this principle to Bitcoin, Peterson believes that as the digital currency’s user base expands, its intrinsic value is expected to grow exponentially. The paper details how to use the “square root time” model to combine the traditional concept of time value of money with the non-linear growth rate typical of network economics, providing a convincing case for Bitcoin’s future valuation trajectory.

Peterson’s approach specifically incorporates elements of conservative financial analysis by highlighting Bitcoin’s all-time low price. “By focusing on the lowest price, the analysis inherently takes a conservative stance, underestimating rather than overestimating value,” Peterson noted, which helps “minimize the risk of overestimation and ensure that forecasts are not overly relied upon that may not be Optimistic scenario for realization”.

Related Reading

Peterson’s paper also discusses potential anomalies and market manipulation that could distort price perceptions. By focusing on NLB, this analysis filters out such distortions, providing a purer view of Bitcoin’s value appreciation, unaffected by short-term speculative pressures or external shocks such as market abnormalities caused by COVID-19 in 2021.

Peterson predicted a new all-time high by March 2025, reflecting broader confidence in the continued growth of the Bitcoin network. As the adoption curve continues to rise and network effects further solidify Bitcoin’s value, this prediction is not only speculative but is based on quantifiable and observed historical trends.

Peterson concluded: “As long as adoption continues, the value of Bitcoin (as represented by the NLB price) will rise. If adoption is hindered, then the price will stagnate or fall.

At press time, BTC was trading at $58,192.

Featured image created with DALL·E, chart from TradingView.com