Loyalty business on Fiat standards

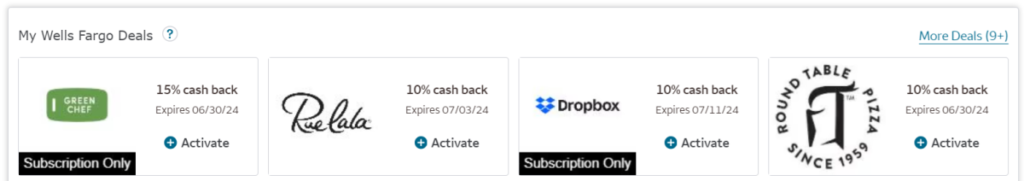

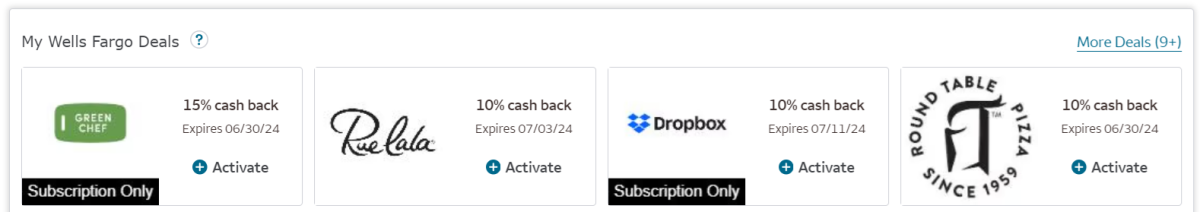

I spent the past ten years working in Mastercard’s San Francisco office building card-related offer solutions to drive merchant loyalty. It’s a fascinating business that allows cardholders to receive merchant offers through their bank and receive discounts if they make qualifying purchases at participating merchants. Below is a sample of these offers/deals from my personal Wells Fargo account.

These offers can drive new customer acquisition, reactivate lost customers, and increase purchase frequency and “basket size” for existing customers. Overall, marketing solutions are very effective in driving incremental spending behavior, primarily through credit card (and some debit card) payment channels.

Enter Bitcoin

Bitcoin doesn’t get a lot of attention as a medium of exchange because Bitcoin holders are supposed to hold on to their Bitcoins, and there’s understandable anxiety about spending creating a taxable event, but putting those concerns aside, Let’s take a look at the business opportunities driving businessmen’s allegiance to Bitcoin rather than fiat currencies. What’s changed? It is no exaggeration to say that Bitcoin has revolutionized the value proposition, delivering unprecedented economic surpluses with efficiencies and use cases that fiat currencies cannot match.

cost

Providing any fiat currency merchant discount program is an expensive task that requires a large and complex technology stack and personnel team: certifying participating merchants, confirming merchant contracts, allocating discounts to cardholders based on predicted marketing budgets, and testing qualifications spend events, redeem cardholders through bill point rewards, compile reports for merchants to show program performance, and reconcile bills. The bottom line is that all consumer spending is driven through the most expensive payment channel (for merchants); credit cards.

Bitcoin Orbit gives up a ton of steps in the process. Merchants can participate in a more Google Adwords-like model via a self-service portal, instantly funding marketing budgets by pledging Bitcoin for verification (this can also be abandoned instantly – never possible in statutory offer programs). Banks and card processors no longer serve as gatekeepers for end-to-end solutions; they and their associated costs/fees are completely removed from the value chain. Best of all, redemption transactions are now all driven on low-cost Lightning Network rails, eliminating not only the direct cost of credit card fees (typically 3% or more), but also the indirect costs of chargebacks and fraud.

new paradigm

Fiat Rail means consumers participating in the bank’s merchant offer program typically don’t receive any notification at the point of sale that they’ve successfully received a discount, and the discount itself doesn’t show up as a statement credit until days later. Banks can invest in instant-notice offer-and-redemption solutions, but doing so is costly and complex and must be done on a bank-by-bank basis; few do, and there is no universal protocol that can be leveraged.

Merchants must fund statutory offers in advance through pre-financing of a committed budget, or by chasing payments through a typical “30-day” type credit agreement (backed by contractual obligations).

Bitcoin Orbit completely turns these traditional frameworks on their head. Consumers not only receive notify Gain instant peace of mind at the point of sale when they take advantage of Bitcoin native offers, but they receive discount Also in real time. Not only that, but technologies like LN Bits and Bolt 12 also support “split payments,” where Bitcoin-native offer providers/companies can get paid instantly at the same point-of-sale event. This essentially renders the statutory “billing” step obsolete. Merchants can also change the offer value, minimum spending threshold, and most importantly stock They want the remaining offers/discounts (marketing budget) committed immediately; this change is impossible to achieve through statutory channels, which require budget commitments weeks in advance. I’ve only scratched the surface of the long list of unfair advantages that Bitcoin brings when it comes to offering merchant discount programs, but I’ll leave it there for now.

Precautions

Reach: Offers programs are essentially a two-sided market, and it’s important to have the largest possible consumer audience to make merchant participation worthwhile. The audience of Bitcoin holders, and what I call the “interested in Bitcoin” audience, while growing, is still a relatively small group.

Goal: The Fiat merchant offer program has a panacea that is currently unachievable on Bitcoin, at least not directly; the consumer’s transaction history. This history allows merchants to carefully spend their marketing budgets on specific consumer groups, such as new, lapsed, and loyal groups. This is an invaluable tool for ensuring the highest return on ad spend (ROAS), and also provides insightful pre- and post-testing and controlled “incremental” reporting to prove campaign spend improvements, for merchants who need it. Very convincing and useful.

That said, I think it is possible for merchants to appeal to the Bitcoin user base, even in a broad and untargeted way, mitigating these caveats because that group is so valuable; skewing towards the wealthy, influential, and fanatically loyal Bitcoiners Friendly business.

The above are examples of how Bitcoin removes costs from legacy systems like never before, unlocking higher profits for merchants and delivering a more direct, visceral and satisfying consumer experience. This long list of unfair advantages offered to Bitcoin-native merchants cannot be replicated by any competitor operating on the fiat track. This is based on my experience working on CLO merchant loyalty programs over the past ten years.

Michael Thaler says “Buy Bitcoin and wait”. For many of us Bitcoin enthusiasts, we have the opportunity to not just “wait in” but to proactively help drive hyper-Bitcoinization. I’m taking this step towards merchant offers, using my expertise and experience to make Bitcoin native offers a reality. I’m curious to see what huge cost savings and new, unique use cases other Bitcoin users can discover by reflecting on their fiat mining experience and expertise and reimagining it through the lens of Bitcoin.

This is a guest post by John McCabe. The views expressed are entirely their own and do not necessarily reflect the views of BTC Inc or Bitcoin Magazine.